Building DeFi’s Bridge to Bitcoin

Decentralized finance (DeFi) has grown by leaps and bounds in just a couple of years, boasting more than $1 billion in total value locked at its peak in February 2020.

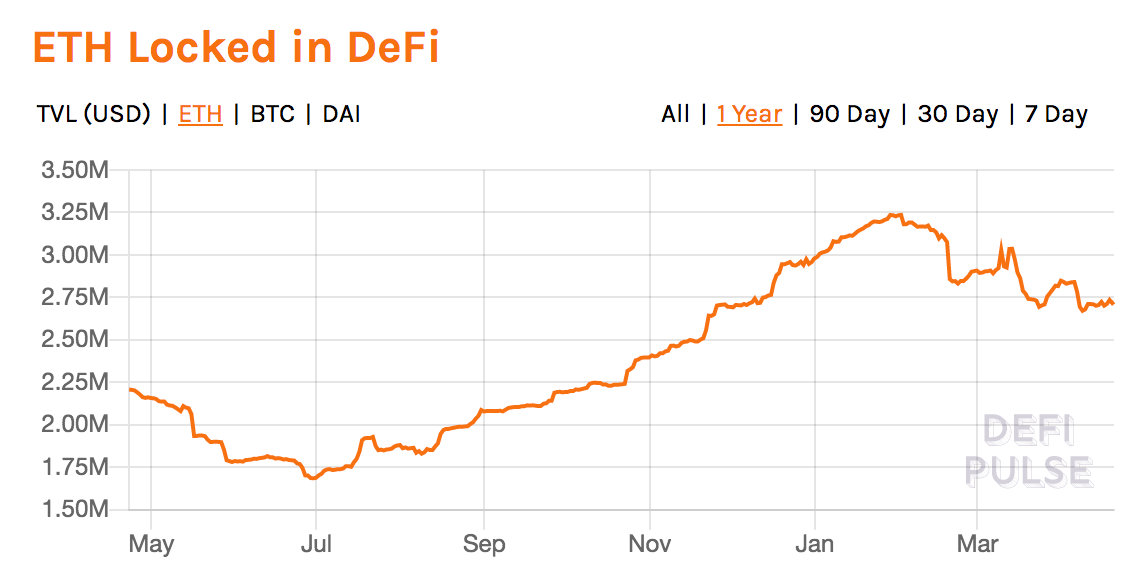

In spite of occasional speed bumps and hacks to DeFi platforms, like this weekend’s dForce hack, users are attracted to the notion of borrowing money, earning interest on their crypto assets and trading derivatives on trustless, transparent DeFi applications. DeFi market value is currently on par with levels from December 2019, which is impressive given the current economic environment and the number of exploits that occurred on lending protocols during the March 12 crash.

While growing rapidly over the past 3 years, DeFi has still been mostly confined to the Ethereum ecosystem. Users can utilize ETH and ERC-20s as collateral to mint DAI on Maker, borrow money on Compound, go leveraged long/short on DDEX or trade derivatives on Synthetix. Ether essentially functions as the reserve currency for DeFi, but represents only a minority of crypto assets (and traditional assets) in the world.

While Ethereum’s turing-completeness and rich smart contract ecosystem provides the backdrop for DeFi, limiting users to Ethereum based assets imposes a glass ceiling on DeFi’s growth. There have been many attempts to bring real world assets to Ethereum, but those efforts have mostly been unsuccessful. If DeFi is to take the next leap in scaling, it must expand beyond Ethereum to other blockchains. Bitcoin would be the most logical next step.

Almost everyone in crypto holds BTC, which represents 63% of all crypto assets according to CoinMarketCap. Bitcoin’s liquidity, brand recognition and user base dwarfs any other crypto asset. Removing BTC from the DeFi ecosystem would be the equivalent of cutting exposure to the U.S., Japan, and China from your global equity portfolio. Put simply, allowing users to access BTC through DeFi would radically expand the addressable market.

Wrapped BTC: Bitcoin’s Dominance With Ethereum’s Functionality

Creating a DeFi ecosystem on the Bitcoin blockchain has largely failed due to a lack of composability and smart contract functionality that is present on Ethereum (and other chains). The majority of efforts to date have been focused on interoperability and atomic swaps, which while promising, have gained little meaningful traction.

Enter wrapped bitcoin (wBTC) — a BTC-backed ERC20 token on Ethereum. Each wBTC in existence is backed 1:1 by Bitcoin held in cold storage by BitGo, one of the leading cryptocurrency custody providers. Although wBTC is not fully trustless, it standardizes Bitcoin to the ERC20 format in a reliable and transparent manner, similar to USDC, PAX, and other reserve-backed stablecoins, allowing Bitcoin to be used in any Ethereum smart contract.

wBTC can be an excellent bridge from Bitcoin to DeFi, but the process of getting your hands on this unique token has been slow and inefficient. Unlike the reserve backed stablecoins, the primary way to acquire wBTC is to buy it with ETH on a decentralized exchange. This means that if you have BTC and want wBTC, you have to sell BTC for ETH on a centralized exchange, transfer to a decentralized exchange with potentially limited liquidity, and then buy wBTC with ETH. Obviously this is not ideal.

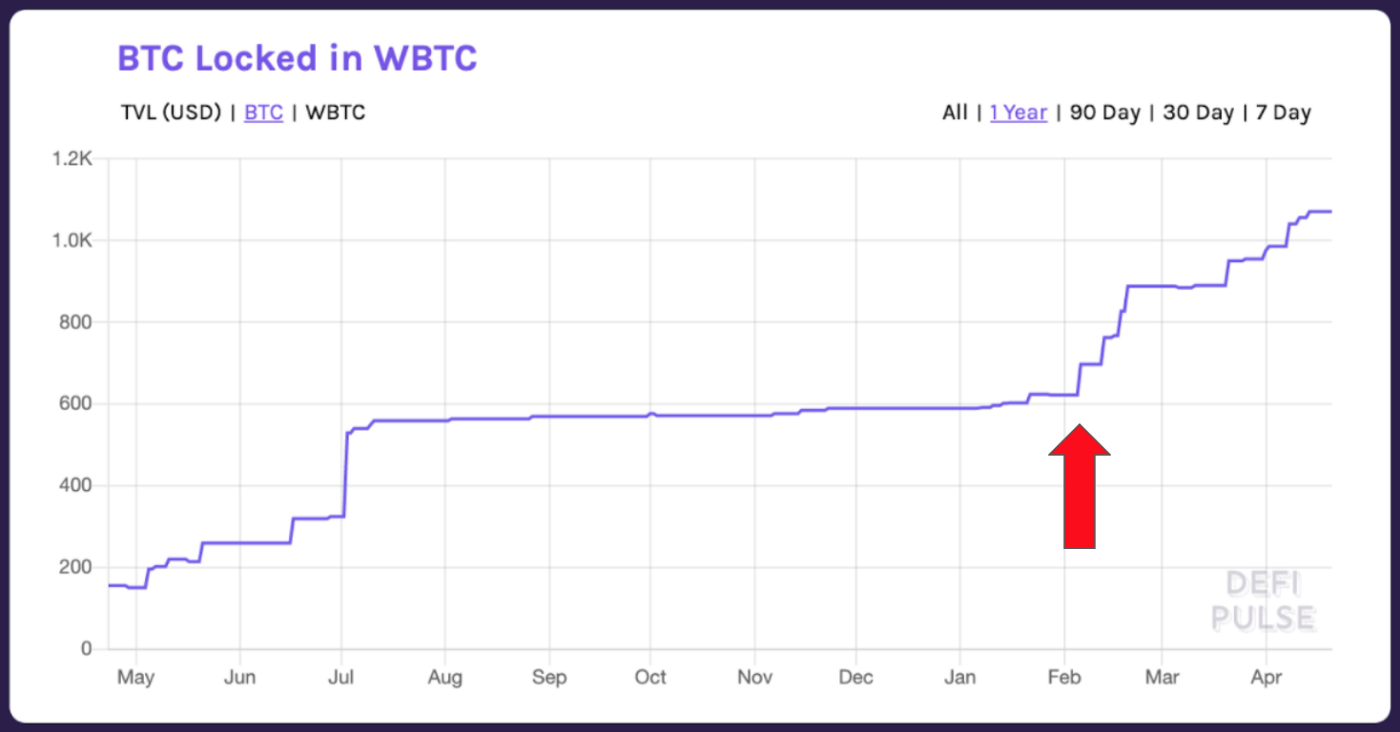

At CoinList, we solved this problem by allowing our users to instantly convert BTC for wBTC, and vise versa, directly via your wallet. Since launching the wBTC/BTC service for institutions in February, CoinList has minted 25% of the total wBTC supply ever in existence and traded 20% of the ADV (average daily volume). Now, we are opening this to all our users.

Bitcoin’s DeFi Moment

With wBTC, BTC’s deep liquidity and large volumes can be injected into DeFi applications.

Users can already earn interest on their wBTC through Compound without relying on a centralized lender, however it is not yet accepted as collateral. The same goes for Maker CDPs that do not yet accept wBTC as a valid collateral type. This might seem ironic as BAT is a valid collateral in Maker’s ecosystem, despite having an ADV ~500x lower than BTC’s. Adding wBTC to Maker’s collateral universe would dramatically increase its resilience to ETH-related price shocks, while increased availability of wBTC could lead to tighter spreads on wBTC pairs on decentralized exchanges.

By combining the ubiquity and maturity of BTC with the functionality of ETH, wBTC could unlock a whole new pool of sophisticated and well-capitalized users for DeFi and further scale adoption of both ETH and BTC.

Don’t miss this growth opportunity for DeFi. Wrap your first Bitcoin on CoinList.

Refer a friend to CoinList and, when they trade their first $100, you’ll automatically earn 0.0015 BTC (~$10) and a chance to win 1 BTC. More details.

Legal Notice

* Fees are subject to change at any time, for more details on fees please visit coinlist.co/legal

This post is being distributed by Amalgamated Token Services Inc., dba “CoinList.” CoinList operates CoinList Markets LLC (“CLM”), a licensed money services business (NMLS #1785867) and CoinList Services LLC (“CLS”), a technology company that offers compliance and technology infrastructure solutions for token issuers. Neither CoinList, CLS nor CLM make investment recommendations, or provides legal, investment, banking, broker-dealer or tax advice or conducts investment diligence on token issuers or any tokens or token-based securities mentioned in this post, and no communication, through the CoinList website or in any other medium, should be construed as a recommendation to enter into any transaction or investment strategy in connection with any token or security offered on or off any Coinlist platform. The listing of tokens and token-based securities on the CoinList website does not suggest the future or expected value of any token or explicitly or implicitly recommend or suggest an investment strategy of any kind. These types of investments involve a high degree of risk (including risk of total loss) and potential investors should consult with their own advisors. CoinList does not receive compensation for publishing, giving publicity to, or circulating notices or communications that describe securities. Potential investors must conduct their own due diligence of any issuer, cryptocurrency, token or token-based security. Investing in cryptocurrencies, tokens and token-based securities is highly risky and may lead to total loss of investment. Use of the CoinList website is subject to certain risks, including but not limited to those listed here.

Certain services may be limited to residents of certain jurisdictions, and certain disclosures are required in certain jurisdictions, available here.

Virtual currency is not legal tender, is not backed by the government, and accounts and value balances are not subject to Federal Deposit Insurance Corporation or Securities Investor Protection Corporation protections. CoinList does not receive compensation for publishing, giving publicity to, or circulating notices or communications that describe securities.

This post contains external links to third-party content (content hosted on sites unaffiliated with CoinList). While CoinList uses reasonable efforts to obtain information from token issuers which it believes to be reliable, CoinList makes no representation that the information or opinions contained in this post, or any third-party content/sites that may be accessible directly or indirectly from this post, are accurate, reliable or complete. Linking to third-party sites in no way implies an endorsement or affiliation of any kind between CoinList and any third party. The information and opinions contained in this post are subject to change without notice, and this post is subject to the terms available here.