How to Structure Your Incentivized Testnet

User acquisition in crypto presents significant challenges, particularly when aiming to attract validators, developers, and knowledgeable crypto enthusiasts for network or product testing prior to mainnet launch. This task is further complicated by the intricacies of testnet participation, where the structure of programs and incentives must be carefully crafted to appeal to high-value users. As a result, executing such initiatives becomes a complex and resource-intensive endeavor.

While established crypto projects can draw upon their existing communities to take part in these testnets, early-stage projects must go to additional lengths to promote community involvement and find the right participants to battle-test their network in a lower-risk, decentralized environment.

To assist in this process, we've crafted a comprehensive six-step guide on designing an effective and enticing incentivized testnet program. This guide draws from insights gleaned from past testnet programs launched on CoinList (including Solana, Filecoin, Sui, Celo, ZetaChain, bitsCrunch, Subsquid, etc.), as well as from our team's extensive user research and practical experience. The six sections are:

- Define the purpose and target audience for your testnet

- Set a timeline

- Determine participation eligibility

- Determine testnet activities

- Determine reward structure to incentivize desired behavior

- Promote your testnet to attract ideal participants

We trust that this guide will prove invaluable to your endeavors.

1. Define the Purpose and Target Audience for Your Testnet

Incentivized testnets can be implemented with a variety of goals in mind. Identifying the most critical components of the protocol to test in a decentralized manner is a great starting point for honing in on downstream considerations such as program scale, eligibility criteria, and benchmarks for success.

While many programs primarily concentrate on assessing the performance and security of node infrastructure, there are other suitable purposes for an incentivized testnet. These programs typically focus on one or more of the participant ‘profiles,’ depending on the testnet’s purpose:

- Validators/node operators: focused on network security

- Developers/technical users: aimed at smart contract development and bug identification

- ‘Retail’ power users: testing protocol features and functionalities

Projects targeting multiple participant types may adopt a phased approach. For instance, the Sui testnet was divided into at least three stages: the initial phase emphasized validator setup and code deployment, followed by the exploration of economic mechanisms (such as staking delegation) and DeFi primitives, and finally, validator performance assessment.

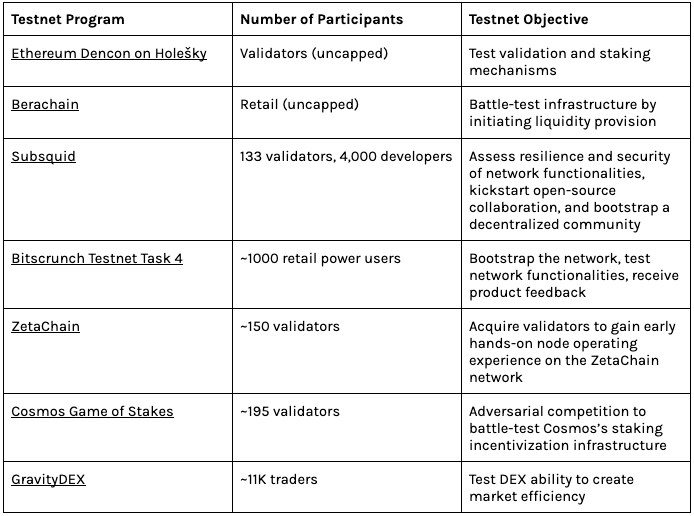

Below, you will find examples of past testnet programs, detailing the number and type of participants they targeted, and the respective objectives of each testnet:

2. Set a Timeline

Incentivized testnet campaigns typically span 3 to 6 months, structured into several distinct phases, each lasting 1-2 months. Testnets that focus on validators or node operators tend to have longer durations compared to those targeting retail users. However, participants generally show limited sensitivity to the length of testnets: in a recent survey we conducted with testnet participants, approximately 36% indicated their willingness to engage for periods of 6 months or longer.

Many projects outline their testnet timelines as "subject to change" based on project requirements and team discretion. Nonetheless, it's important to acknowledge that participants may react negatively to frequent timeline adjustments, especially if there isn't a corresponding increase in rewards to compensate for the extended time and effort.

Projects should exercise careful consideration and diligence when communicating any modifications to the testnet timelines.

3. Determine Participation Eligibility

Projects should always aim to clearly define the eligibility criteria for participation and reward distribution to uphold a certain standard of quality among participants. Projects typically define a set of Terms & Conditions for their incentivized testnet that governs eligibility (see example from ZetaChain).

Many projects do not require KYC for participation but do require it for select testnet participants eligible for rewards. Participation limits are typically uncapped for developers and user-based testnets, while node operators/validators are generally capped based on the desired active set at launch. Validators/node operators are typically selected through an application process, with reward eligibility contingent on performance during the testnet.

4. Determine Testnet Activities

The activities within a testnet should primarily focus on directly testing and interacting with the network, with variations depending on the campaign’s purpose and target audience.

For programs geared towards validators, tasks may involve running a node, processing transactions, monitoring uptime/downtime percentages, and managing network-related metrics.

- Example: Ethereum’s Dencon upgrade on the Holešky testnet aims to scale the network by enhancing data throughput management and reducing network costs. The testnet targets validators seeking to test protocol upgrades before deploying them on the mainnet.

For program targeting retail users, activities could include initiating transactions, interacting with dApps, staking, utilizing the testnet faucet, setting up accounts/connecting wallets, providing feedback, reporting bugs, and more.

- Example: Berachain’s recent testnet is tailored for retail power users to stress-test Berachain’s trading infrastructure by bootstrapping initial liquidity and identifying potential issues prior to mainnet launch.

For developer focused programs, tasks may involve deploying smart contracts, building lite applications, identifying and resolving bugs, and other development-related activities.

- Example: In Subsquid’s recent incentivized testnet, developers were incentivized to earn tSQD by completing quests within Subsquid’s network app. The top 4,000 participants received SQD rewards at mainnet launch, vesting over a six-month period.

While some testnets may include “social media” related, these should never be the primary or sole objectives of the testnet. Any social tasks soliciting the token itself or suggesting price performance comparisons, such as tweets implying the price of the network token will outperform BTC should be excluded from testnet activities.

5. Determine Reward Structure to Incentivize Desired Behavior

Arguably the most pivotal element in incentivized testnet design is crafting appropriate incentives and rewards to: (1) facilitate comprehensive testing of all functionalities and (2) enable participants to gain valuable experience ahead of the mainnet launch.

Testnet rewards commonly take the form of the native token post-mainnet launch (although stablecoins may serve as an alternative), with projects typically allocating between 0.5% to 2.5% of total token supply for rewards. This allocation depends on factors such as project valuation, the projected number of reward recipients, and the level of engagement required for testnet participation.

In our recent testnet survey, the community identified the reward amount as the single most important factor influencing their decision to participate in a testnet.

Rewards commonly fall into two distinct categories: performance-based and participation-based.

- In performance-based reward systems, participants complete predefined activities to earn points or tokens and may compete against each other on a leaderboard. These programs foster high levels of competition, encouraging participants to coordinate within certain boundaries to stress-test game theory mechanics, thus validating network resilience against potential bad actors. Rewards are distributed proportionally to participants' rankings, allowing projects to identify and reward top contributors. For retail tests, rewards are typically limited to the top 1,000-2,000 participants, while validator and developer-focused testnets usually cap rewards at 100-300 participants.

- For participation (task)-based rewards, participants earn rewards upon completing a predetermined set of non-competitive tasks. This structure can be particularly effective in encouraging broad participation for retail users and performing targeted stress-testing of specific features. Generally, these programs attract a larger user base, even if participants are less likely to achieve top rankings.

While participation-based programs are more popular among retail users (as indicated by a 69% preference in our survey), implementing a hybrid approach may effectively balance broad incentivization with rewarding high-value participants.

6. Promote Your Testnet to Attract Ideal Participants

Without an established brand or a large pre-existing community, sourcing high quality participants for your incentivized testnet can pose a significant challenge. This endeavor often demands a substantial marketing budget and operational resources.

At CoinList, we eliminate the complexity of running incentivized testnets, allowing you to focus on building. Through our testnet offering, we provide crypto builders access to a vast pool of validators, developers, and early adopters with a track record of contributing to leading protocols such as Solana, Filecoin, Sui, Celo, ZetaChain, bitsCrunch, and Subsquid.

In addition to facilitating participant sourcing from our community of over 10 million crypto early adopters, CoinList provides KYC checks, and where available, can distribute rewards on-chain or directly to verified accounts on our platforms, complete with customizable vesting schedules.

To learn more about how we can best support your incentivized testnet, contact us today.

Legal notice

This post is being distributed by Amalgamated Token Services Inc., dba “CoinList,” or one of its subsidiaries. CoinList does not provide—and this post shall not be construed as—investment, legal or tax advice. This blog post and use of the CoinList website is subject to certain disclosures, restrictions and risks, available here and here.