Crypto Tax Basics: What You Need To Know

Disclaimer: The information provided in this course is general in nature and is not tax, accounting or legal advice. It has been prepared without taking into account your objectives, financial situation or needs. Before acting on this information, you should consider the appropriateness of the information with regard to your own objectives, financial situation and needs and seek professional advice.

As cryptocurrencies continue to gain traction globally, governments face the challenge of adapting their tax and regulatory frameworks to accommodate these digital assets. Cryptocurrency taxation, a rapidly evolving and intricate domain, varies significantly across different jurisdictions.

In this comprehensive guide, we delve into the diverse approaches to crypto taxation around the world, focusing on prominent regions such as the United States, Europe, and Southeast Asia. We will dissect the tax implications tied to an array of crypto transactions, encompassing trading, staking, airdrops, community sales, NFTs, and non-taxable events. Moreover, this article will offer valuable insights to help crypto taxpayers effectively navigate the complexities of the international cryptocurrency tax landscape.

I. United States

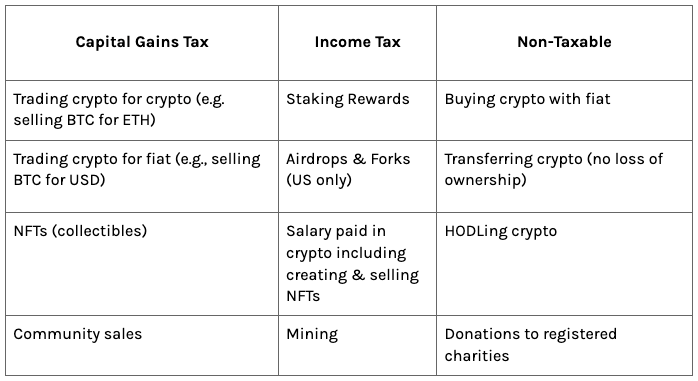

In the United States, the taxation of cryptocurrencies is governed by the Internal Revenue Service (IRS). Looking at table below, we can see the different tax implications for the following activity:

Trading Crypto: Anytime you dispose of a cryptocurrency (whether that be in exchange for another crypto or fiat), it is subject to capital gains tax.

Staking Rewards: In the US, staking rewards are treated as ordinary income. Staking rewards must be reported as income on your tax return at the value on the day it is received.

Airdrops: In the US, airdrops are treated as ordinary income (exactly the same as the tax treatment of staking rewards).

Token sales: The sale or exchange of tokens is subject to capital gains tax.

NFTs: In the US, the tax treatment of NFTs will depend on whether they are collectibles or if you are a creator of an NFT project. If they are considered collectibles, they will be subject to capital gains tax when sold. If you are creating or trading NFTs professionally, they will be subject to income tax.

II. Europe

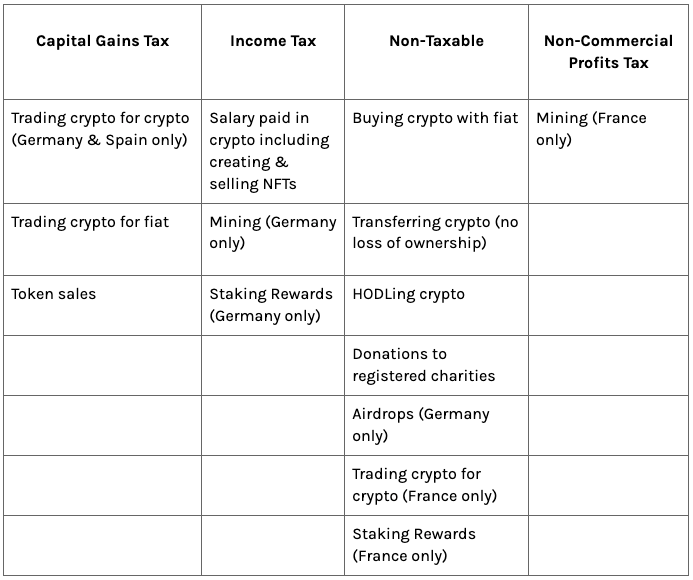

Cryptocurrency tax laws across Europe tend to differ to some extent, with some countries having particularly unique policies. We’ll split this up into 2 tables.

France 🇫🇷, Germany 🇩🇪, and Spain 🇪🇸

A few important things to note:

In France, capital gains are taxed at the following rates:

- Occasional traders - flat tax of 30%

- Professional traders - BIC tax of 45%

- Crypto miners - BNC tax of 45%

In Germany, if you hold your cryptocurrency for over a year, it is tax-free!

In Spain, they refer to capital gains tax as Income Savings Tax

Trading Crypto: In all 3 countries, trading crypto for fiat is subject to capital gains tax. However, trading crypto to crypto is not taxable in France (only Spain & Germany).

Staking Rewards: In France, staking rewards are non-taxable. In Germany, it is considered income tax, whereas in Spain, this is still a gray area (best to chat with a tax professional).

Airdrops: In Germany, airdrops are tax-free! Meanwhile, both France and Spain have not provided any clear guidance on the tax treatment of airdrops.

Token sales: If you sell your tokens in exchange for fiat, this is subject to capital gains tax in all 3 countries. If you sell your tokens in exchange for crypto, it is only taxable (subject to capital gains) in Spain and Germany.

NFTs: Both Spain and Germany have not provided any clear guidance on the tax treatment of NFTs. Meanwhile, selling NFTs are tax-free in France UNLESS you are selling your NFT in exchange for fiat.

Switzerland 🇨🇭

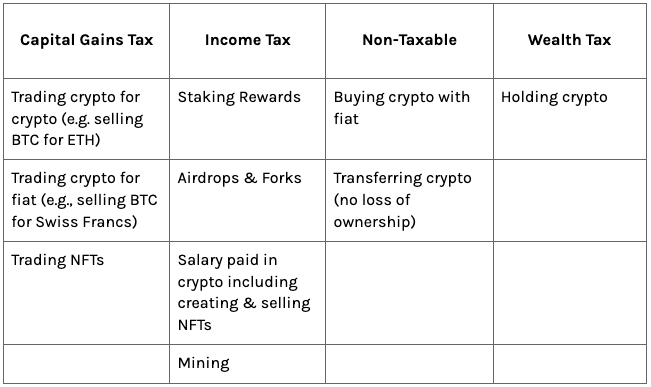

Switzerland has a unique taxation system in which if you classify as a private investor (and not a self-employed trader), you won’t actually be subject to paying capital gains tax. Nevertheless, all taxpayers in Switzerland are still liable to pay income tax, as well as potentially being subject to wealth tax.

Trading Crypto: Trading crypto for fiat or another crypto is subject to capital gains tax. Remember, if you are a private investor then you are not subject to pay capital gains tax.

Staking Rewards: These are taxed as income at the market value of your received coins at the time of the transaction.

NOTE: if you decide to dispose of the tokens you received by airdrop at a later date, it is likely you may also have to pay Capital Gains Tax on these tokens, with the cost basis being the value of the token when you received it. This won’t apply if you are a private investor.

Airdrops: In Switzerland, these have the exact same tax treatment as staking rewards.

Token sales: There hasn't been any guidance from Swedish tax authorities on how token sales should be treated from a tax perspective, so it’d be best to speak to a tax professional on this if you have participated in any token sales.

NFTs: Trading NFTs are subject to capital gains tax, however, if you are a creator selling NFTs for a living, this falls under income tax.

*Wealth Tax: Switzerland also has a wealth tax which applies to your total wealth assets less debt at the end of the financial year period. Your wealth assets include:

- Cash, stocks, equities, bonds

- Physical assets (e.g., gold, property)

- Cryptocurrencies

The wealth tax rates depend on the canton you live in which can be searched up here. Generally speaking, most cantons have a wealth tax that ranges between 0.3% and 1%.

III. South-East Asia

Japan 🇯🇵

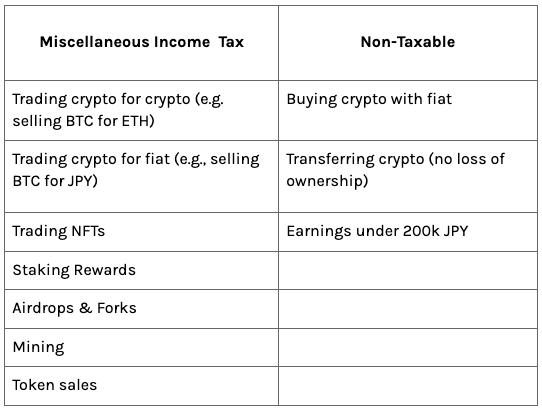

In Japan, cryptocurrency is viewed as property, and the Japanese National Tax Association (NTA) taxes it as miscellaneous income.

Also note, earnings under 200k JPY (Japanese Yen) are considered tax-free. Anything above this threshold needs to be reported and will be taxed.

As seen in the table above, trading crypto, staking rewards, airdrops, token sales, and trading NFTs are all subject to miscellaneous income tax.

You can calculate your total miscellaneous income by summing up the total profits from all the crypto transactions which fall under the ‘miscellaneous income tax’ column and getting a total figure.

To see more on filing your crypto taxes in Japan along with tax rates, check out this guide.

Vietnam 🇻🇳

Despite having one of the largest GameFi communities and has been ranked first in Chainalysis’ Global Crypto Adoption Index two years in a row, cryptocurrencies are not taxed in Vietnam. The government has taken notice of the growing crypto activity in the country, but even after internal discussions with tax authorities, there has been no progress made so far towards taxing or regulating digital assets.

Hong Kong 🇭🇰

Luckily for individual crypto investors in Hong Kong, their investments in cryptocurrencies are potentially considered tax-free. However, for businesses or crypto professionals who are trading digital assets as part of day-to-day business activities, they will be subject to income tax.

IV. Countries with unclear tax guidelines

Russia 🇷🇺

Current tax rates on income earned from the sale of digital assets sits at a flat rate of 20% in Russia however there is no real guidance in regards to tax implications on specific transaction types. There was a proposed tax law which would reduce this rate from 20% to 13% for individuals and potentially exempt investors from value-added-tax, though this law has not been approved yet.

Ukraine 🇺🇦

Engaging in crypto transactions is considered a business activity in Ukraine and any profits derived from such activities are subject to taxation. This tax sits at a flat rate of 18% personal income tax and 1.5% military tax.

Recently, there has been a draft law to offer individuals a 5% personal income tax for a period of 5 years (instead of 18%) and a military tax of 1.5%. Similar to Russia’s recent proposal, this draft law also seeks to make investors exempt from value-added-tax.

At this stage, there is no clear guidance by Ukraine in regards to staking rewards, airdrops, and other crypto activity, however, Ukrainian president, Volodymyr Zelenskyy said that he was looking to make the nation more crypto-friendly and introduce some clear regulatory frameworks.

Turkey 🇹🇷

In Turkey, the regulation of crypto-related developments is currently unclear as there is no single regulatory body overseeing them. Although the President, Recep Tayyip Erdogan, has stated that legislation concerning crypto assets has been prepared for submission to the Turkish Parliament, there is no confirmed date for when this will happen.

In conclusion, the taxation of cryptocurrencies varies significantly across countries, with some yet to provide clear guidance on the matter. Given these disparities, it is crucial to consult local tax advisors to ensure compliance with the tax laws applicable to your specific jurisdiction. This article serves as an informative resource rather than a substitute for professional crypto tax advice tailored to your unique circumstances.

Need help calculating your crypto taxes?

It can be a difficult process to manually calculate the taxes incurred from your crypto transactions as many accountants are inexperienced in this area.

To make the process easier, CryptoTaxCalculator is graciously offering the CoinList community a 20% discount on their crypto tax products using the code COINLIST20 at checkout.

CryptoTaxCalculator automates the data collection process, categorizes your transactions and calculates your capital gains, losses, and income; generating these into a tax report which is compliant with your selected country.

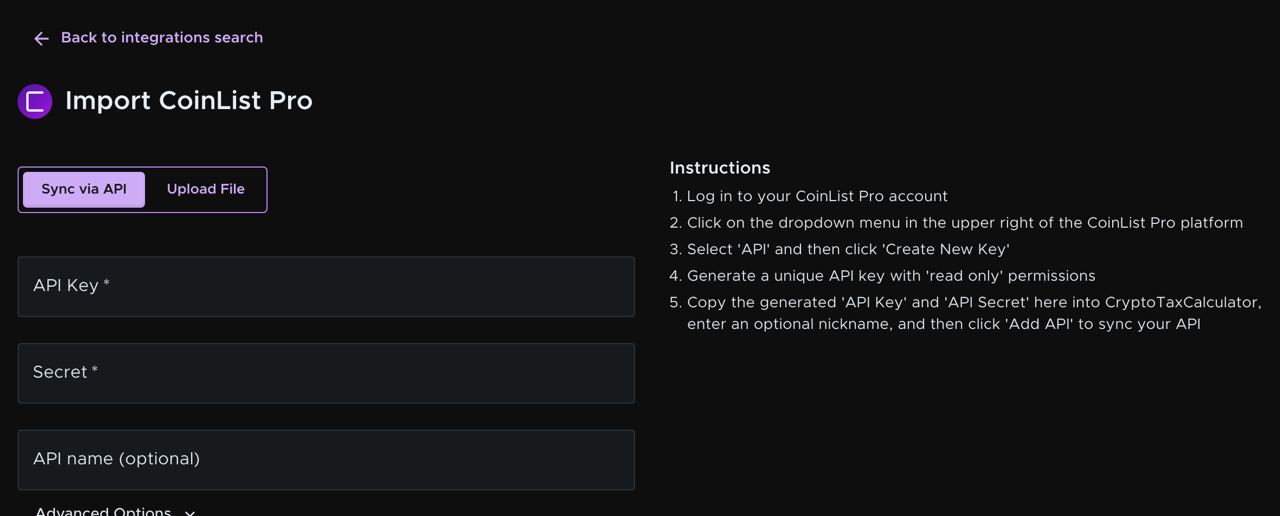

CoinList users can easily use the CryptoTaxCalculator software by uploading their Transaction History CSV directly into the UI or importing the transaction data via API as shown below:

Have you done your crypto taxes yet? 👀

Legal notice:

The information provided in this course is general in nature and is not tax, accounting or legal advice. It has been prepared without taking into account your objectives, financial situation or needs. Before acting on this information, you should consider the appropriateness of the information with regards to your own objectives, financial situation and needs and seek professional advice. Consult a professional regarding your individual tax or legal situation.

This blog post is being distributed by Amalgamated Token Services Inc., dba “CoinList,” or one of its subsidiaries. This blog post and use of the CoinList website is subject to certain disclosures, restrictions and risks, available here.