Five Crypto Trends To Watch in 2022

2021 has been a milestone year for the crypto market. Crypto is not only a hot topic in the financial world, it is now a pillar of popular culture too. NFTs have taken off, BTC and ETH hit new all-time highs, ecosystems on Ethereum alternatives like Solana and Polkadot have grown exponentially, and we have more institutional buy-in from major enterprises than ever before. As we look ahead to next year, here’s what we, and our community, are seeing.

1. Most in-demand category for 2022: Gaming

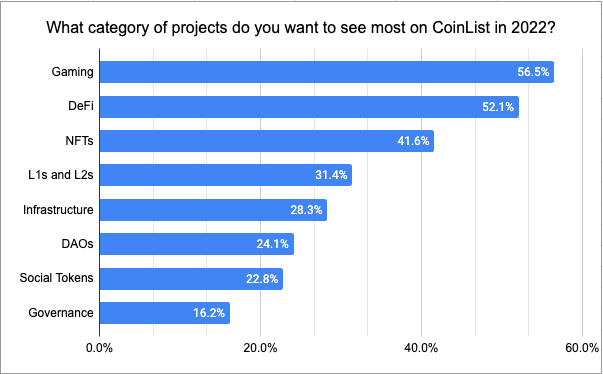

In a recent “Crypto Predictions for 2022” survey with 4,444 respondents, we asked our community what category of projects they wanted to see most on CoinList in 2022. The number one response was gaming (56.5%), highlighting the trending belief that gaming will be the tipping point for mass adoption of blockchain. DeFi (52.1%) and NFTs (41.6%) were the second and third most in-demand categories, followed by L1s/L2s (31.4%), infrastructure (28.3%), social tokens (22.8%), and governance (16.2%).

Play-to-earn games like Axie Infinity are taking crypto mainstream and exposing more people to DeFi and NFTs. As the survey results indicate, the intersection between DeFi and gaming will only grow in 2022, and gaming-focused platforms like Flow and Immutable X stand to gain major traction. Blockchain gaming will allow a new generation of gamers to own in-game assets and trade them on secondary markets, and we look forward to supporting the advancement and adoption of these vibrant ecosystems in 2022.

Gaming and metaverse (a digital universe built in game-like environments) were also voted as the top two use cases for NFTs in 2022, far surpassing profile pictures (the most common use case in 2021), event tickets, membership, and crowdfunding.

Will we see NFTs built into non-blockchain games and platforms like Oculus and Instagram? Will we see a rise in decentralized, user-owned gaming platforms? Time will tell, but given the massive amount of investment going into gaming and metaverse, including pivots into the space from tech giants such as Meta Platforms, we would not bet against it.

2. Ethereum is not the only party worth attending

The Ethereum ecosystem is exceptional. No other platform has directly driven as much innovation in crypto and the metaverse as Ethereum, by a long shot. But while the massive surge in demand we’ve seen this year was a huge net positive for the industry in 2021, this summer’s NFT mania pushed the Ethereum network to its breaking point, and rendered it unusable for many retail users due to high gas fees and scalability problems, prompting them to look for alternative options.

No L1 project grew faster and posed more of a threat to Ethereum this year than Solana, which is laser focused on providing best-in-class speed and execution (not to mention SOL’s 100x rally and listing on CoinList).

2021 was also a big year for the “chain of chains” Polkadot, following a successful rollout of parachain auctions, with many high profile projects scheduled for 2022 (which require users to buy and lock up DOT on an ongoing basis).

When asked what blockchain they were planning to interact with most in 2022 outside of Ethereum, more than 56% of respondents said Solana, followed by Binance Smart Chain (48.8%), Polkadot (47.9%), Avalanche (25%), Polygon (25%), Cosmos (17.5%), and Terra (14.2%). When asked which Layer 1 blockchain will be closest to the ETH market cap by the end of 2022, survey responses followed the same pattern.

3. Bitcoin stays King: No flippening

Bitcoin is up more than 150% in 2021, and given the strong macro tailwinds and rising inflation, it is difficult to envision a world where bitcoin falls out of favor while the rest of crypto climbs. Despite bitcoin dominance falling from 70% to 41% this year, its only real competition is Ethereum. Given the increased competition Ethereum is facing from other L1s, however, it is difficult to imagine a flippening taking place in 2022.

Institutional investors are more comfortable than ever with the idea of digital gold, and with an increasing number of institutional vehicles available to investors, it’s safe to say that the institutions have officially arrived. Individuals that publicly own Bitcoin now include the likes of Tim Cook, Jack Dorsey, Elon Musk, Stan Druckenmiller, and Paul Tudor Jones. Governmental adoption followed suit. In September, El Salvador officially adopted bitcoin as legal tender, meaning it can now be used in any transaction, from buying coffee to paying taxes.

Will more countries follow El Salvador’s model in 2022? 87.3% of our survey respondents say yes.

When asked for their BTC price prediction for 2022 with a minimum price of $100,000, 46.8% of survey respondents expect the BTC price to reach between $100,000 and $150,000, while 10.9% expect price to exceed $200,000.

Another trend we anticipate in 2022 is accelerating Bitcoin flow into DeFi. Wrapped Bitcoin (WBTC) has more than doubled its supply from one year ago, with more than $5.6 billion of WBTC in existence being minted on CoinList. We expect to see tokenized versions of Bitcoin not just on Ethereum but on every major layer-one protocol as they build out their DeFi offerings.

Smart investors want to do more with their Bitcoin than just HODL. And “doing more” means moving your bitcoin to Ethereum and other protocols where financial innovation is thriving. The rapidly growing demand for WBTC comes as yields for bitcoin borrowing and lending have grown less competitive compared with the lucrative DeFi lending market. We’ll see new ways to port your BTC to other blockchains using centralized bridges like CoinList or decentralized ones like tBTC. Other tokenized assets will come online, but tokenized Bitcoin will continue to dwarf them all. There is enormous upside potential in this market.

4. A cornucopia of token distribution strategies

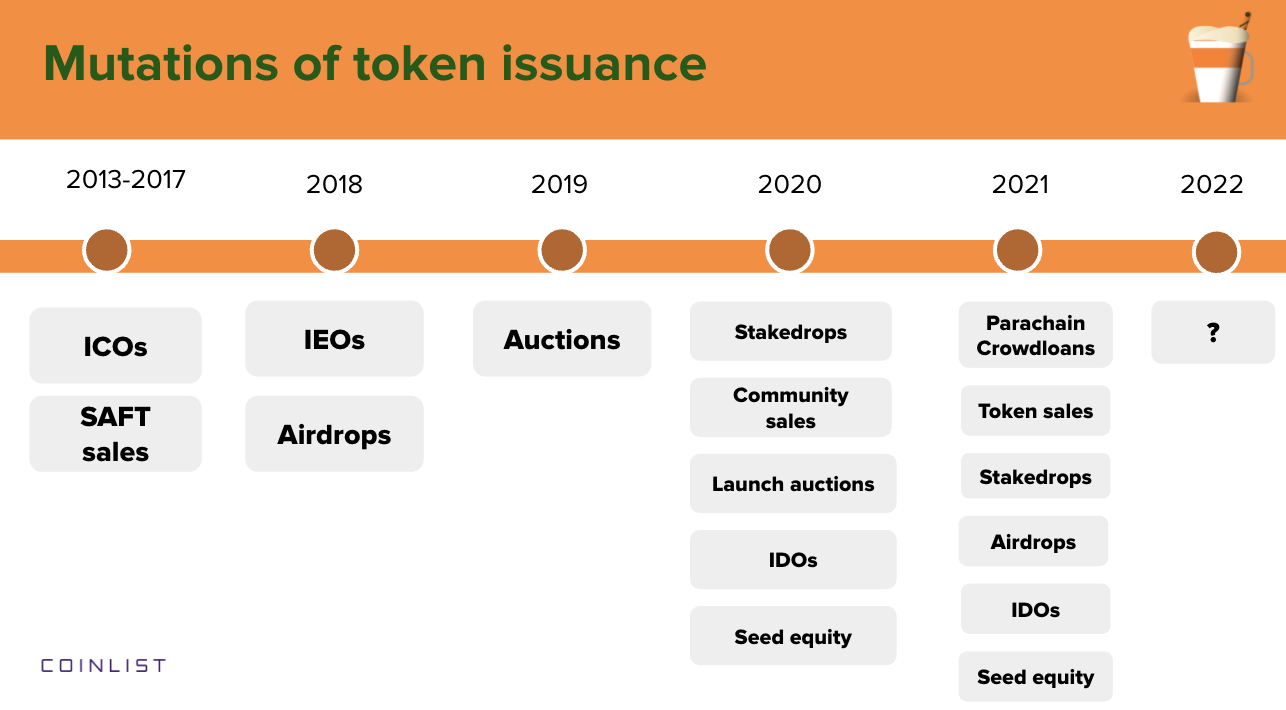

With BTC, ETH, and L1s posting major rallies in 2021, more crypto capital will be looking for places to be put to work in 2022, and issuance is one of the primary places. It is one of the most dynamic corners of this industry, and we love being at the forefront of it.

Smart crypto enthusiasts know that being early is critical to success, and getting access to cutting-edge crypto assets before they list on major exchanges is about as early as you can get in this space.

With traditional equity markets being almost completely illiquid, slow, and restrictive to most individuals, investors worldwide are attracted to the liquidity, transparency, and powerful network effects of the crypto markets. In just a few years, the crypto industry has spawned an ever-evolving array of exciting token distribution models that have captured investor attention. No sooner had the enthusiasm surrounding ICOs faded before the markets got caught up in the thrill of IEOs, launch auctions, and token farming.

Since 2017, almost every team we’ve worked with has come up with their own take on token issuance. From launch auctions like Solana and Celo, community sales like Flow, Mina, and Casper, worklocks like NuCypher and Oasis, liquid token sales Rally, and Polkadot Crowdloans like Acala and Moonbeam, we’ve seen a cornucopia of issuance and fundraising strategies this year and expect this trend to continue in 2022. More importantly, we’re seeing a dramatic increase in the quality and quantity of new protocols, applications, and networks — a hugely bullish sign for the industry.

We’re also seeing increased activity and appetite at the seed stage, given crypto private equity outperforming traditional private equity across one, three and five-year horizons. We’ve seen signs of this through our demo day for early-stage crypto startups — CoinList Seed. In 2021 alone we hosted over 40 startups in the program, including companies like Injective Protocol, Acala, Clover Finance, Rabbithole, and many more. Many startups presenting have gone on to raise from top tier investment funds including Electric Capital, Pantera Capital, Multicoin, Placeholder, and more.

5. Decentralized software will eat software

The term “Web 3” arrived with a bang in 2021, used as a moniker for the decentralized tech movement. The central thesis here is that we are going from an internet built on “rented land” with monopoly overlords, to an internet “owned by the builders and users, orchestrated with tokens” (Chris Dixon).

As we discussed in a recent blog post, decentralized software is starting to gain traction and eating its centralized counterparts, and we are witnessing an increasing explosion of startups that build decentralized versions of Web 2 platforms and services. These Web 3 ecosystems will be open source, permissionless, and supported by token economies.

As decentralized software takes on more traditional software verticals — search, social, ecommerce, SaaS — we’ll see an influx of thousands more tokens and protocols.

At the same time, we are seeing an increasing number of Web 2 companies integrating Web 3 structures into their business models. In our EOY survey, we asked our community how they think Web 2 companies will integrate crypto & Web 3 in 2022. The number one response was increased adoption of crypto payments rails (52.3%), followed by rewarding existing communities with in-platform economies (40.7%), and building open source products (30.3%).

In the last year alone, there has been a surge in adoption of crypto payments rails across a wide range of businesses: PayPal launched a crypto payment product, allowing their customers to checkout with Crypto across all 29 million merchants that accept PayPal; Twitter rolled out a “Tips” feature that supports crypto payments, allowing users to link their CashApp, Patreon, or Venmo and receive tips in crypto; Visa and MasterCard introduced crypto services and crypto payments to their customers. This is all great for the ecosystem in 2022.

As more capital, more competition, and more regulation move into crypto, we will all have to step up and do the hard work of passionately serving our users. For CoinList, this means discovering and vetting new and unique opportunities that excite our community and helping the blockchain ecosystem thrive.

More exciting times - and more tokens - ahead.

Legal notice

This blog post is being distributed by Amalgamated Token Services Inc., dba “CoinList,” or one of its subsidiaries. This blog post and use of the CoinList website is subject to certain disclosures, restrictions and risks, available here.

This blog is for informational purposes only, and you should not construe information herein as legal, tax, investment, financial, or other advice, nor as a solicitation, recommendation, endorsement, or offer by CoinList or any of its subsidiaries to buy or sell any tokens, securities or other instruments in any jurisdiction in which such solicitation or offer would be unlawful under the laws of such jurisdiction.