Crypto Predictions For 2023 From The CoinList Community

In a recent “Crypto Predictions for 2023” survey, we asked our community of crypto early adopters what they are excited about in 2023.

Over 1,000 early adopters from around the world participated in the survey. This represents a crypto-native demographic that has the guts and foresight to identify high-quality token projects pre-launch, participate in token sales for top projects like Solana, Near, Algorand, and Filecoin, and continue to discover the newest innovations in crypto before they go mainstream. So perhaps they have some insight into what’s in store in 2023.

Here’s what we found:

1. Most in-demand category in 2023: DeFi

One of the questions we asked in our survey was what category of projects early adopters wanted to see most on CoinList in 2023. The number one response was DeFi (54.3%), highlighting the trending belief that, having seen a strong bullish phase and a grueling bearish slump, DeFi may be poised for stable growth in 2023.

L1s/L2s (44.1%) and Gaming (42.4%) were the second and third most in-demand categories, followed closely by Cross-Chain Infrastructure (37.3%). Categories like NFTs, DAOs, Governance, and Social Tokens drew less interest. In a separate but related question, 47% of respondents believe that DeFi and Gaming will be the two mega-trends that will drive widespread crypto adoption, far exceeding any other categories.

Will DeFi defy expectations in 2023, survive regulation, and onboard the next wave of institutional interest? Time will tell, but given that financial services firms like BlackRock, Citigroup, Goldman Sachs, Morgan Stanley, and Fidelity have invested heavily into DeFi the past two years, we would not bet against it.

2. New L1s close the gap on incumbents

Layer 1 blockchain projects have always attracted the most attention and capital in crypto. The top 20 layer 1 blockchains collectively represent more than 75% of the entire crypto market cap.

When asked what blockchain they plan to interact most with in 2023 outside of Ethereum, the top three answers were Cosmos, Binance Smart Chain (BSC), and L2 rollups/sidechains (Arbitrum, Polygon, Optimism), each netting about 40% of the votes. What this tells us is that BSC has significant product-market fit, L2s are a serious thing, and people really want to use Cosmos.

Another interesting finding is that interest in newer chains like Sui (34.8%) and Aptos (34.5%) far surpassed interest in existing incumbents like Avalanche (13.1%) and Solana (17.8%). While incumbent chains certainly benefit from being early movers, new entrants are poised to close the gap in 2023— assuming they are capable of resolving substantial scalability pain points and providing strong developer experience / user experience.

3. Catalysts for growth: Improved security and real world applications

Looking ahead, more than half of the respondents cited more real world applications (57.6%) and improved security (53.6%) as the two biggest issues the crypto space needs to address in order to see more widespread adoption. User education and regulatory clarity were third and fourth, cited by about 42% of respondents each. We can deduce that while the lack of regulatory clarity is without a doubt a blocker for growth, more tangible use cases and applications are needed for crypto to attract more users and accelerate network effects.

4. A call for regulation

Of the multiple factors that impact their consideration when investing in crypto, respondents identified regulatory uncertainty and market manipulation as the top two concerns, followed closely by security of asset custody. Fewer rules can represent a trade-off between opportunity and protection, while increased regulation may imply greater safety but more delay in go-to-market. Given the number of massive collapses, scandals, and resulting enforcement actions the crypto community witnessed in 2022, 2023 could be poised to strengthen our appreciation of what regulation has to offer.

5. Bitcoin stays king — no flippening

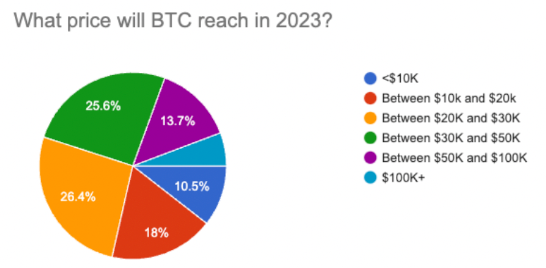

Despite bitcoin price plummeting more than 50% in 2022, it is difficult to envision a world where bitcoin falls out of favor while the rest of crypto climbs. While bitcoin dominance fell from 48% to 42% in 2022, the only real competition in the asset class is Ethereum. Given the increased competition Ethereum is facing from other L1s, it is hard to imagine a flippening taking place in 2023. In terms of BTC price outlook, it appears that the crypto winter has dampened short-term expectations for price appreciation, with more than 50% of respondents expecting bitcoin price to fluctuate between $20k and $50K in 2023, though less than 30% expect it to stay below $20K.

As Vitalik’s tongue-in-cheek April Fools blog post in defense of maximalism points out...

“Assets like bitcoin have a real cultural and structural advantage… and maximalism is… unavoidable and necessary to protect newbies and make sure at least one corner of that space continues to be a corner worth living in.”

6. A long-term perspective

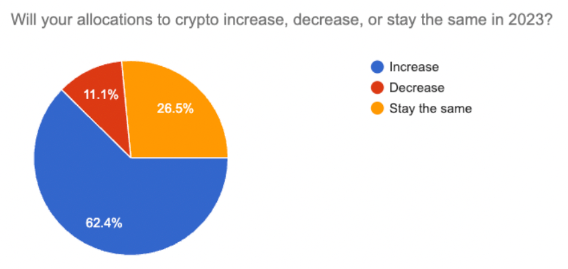

While examining changes in crypto allocations, we found that 62.1% of respondents plan to increase their allocations to crypto in 2023, while 26.7% plan to keep their allocations as-is, choosing to HODL their assets. Evidence suggests that early adopters continue to take a long-term view of the asset class despite the significant decrease in prices.

As more competition and more regulation move into crypto, we will all have to step up and do the hard work of passionately serving our users. For CoinList, this means empowering builders at any stage in their journey, and connecting them with a community of high quality early adopters of their products.

To learn more about how we can best support your crypto project, reach out to us today »

Legal notice

This blog post is being distributed by Amalgamated Token Services Inc., dba “CoinList,” or one of its subsidiaries. This blog post and use of the CoinList website is subject to certain disclosures, restrictions and risks, available here.

This blog is for informational purposes only, and you should not construe information herein as legal, tax, investment, financial, or other advice, nor as a solicitation, recommendation, endorsement, or offer by CoinList or any of its subsidiaries to buy or sell any tokens, securities or other instruments in any jurisdiction in which such solicitation or offer would be unlawful under the laws of such jurisdiction.