What can you do with WBTC?

Part One: Automating crypto asset management with TokenSets

Welcome to our series on what you can do with Wrapped Bitcoin (WBTC). By combining the ubiquity and maturity of BTC with the functionality of ETH, WBTC unlocks a world of possibilities that allow you to put your Bitcoin to work like never before. In this series, we explore how you can use CoinList + various Decentralized Finance applications to trade, lend, and collateralize.

In the first chapter of this series, we introduce TokenSets, a decentralized asset management platform that allows anyone to create their own crypto-native and automated investment and trading strategies. Think of it as a tool to build your ETF, hedge fund, or robo-advisor all managed on-chain and powered by DeFi. The concept is simple, yet intriguing. Let’s explore.

What is Set Protocol?

Set Protocol is a non-custodial protocol and system of smart contracts developed by the Set Lab team and deployed on the Ethereum blockchain. Using this system, users can create “Sets” which are tokenized baskets of assets (i.e. 60% Ethereum + 40% Bitcoin) that are programmatically rebalanced based on any number of predetermined rules (like Relative Strength Index or Moving Averages).

Whereas other trading strategy platforms would require traders to execute trades on secondary exchanges, Set Protocol allows users to hold unique tokens which are automatically rebalanced relative to their intended strategy. In other words, Set allows anyone to create and deploy their own crypto ETF or hedge fund. There are no fees for creating a Set, and the protocol currently supports 4 assets: ETH, DAI, USDC, and WBTC.

What is TokenSets?

TokenSets is a front-end application built by the Set team to help users interact with Set Protocol in a simple and intuitive manner. TokenSets essentially functions as a marketplace for Sets to be bought and sold. This allows non-technical traders to enter and exit sophisticated trading strategies in just a few clicks, without having to execute multiple trades on secondary exchanges. Users can follow the best traders with a click of a button or create their own sets that gather following.

Like most DeFi products, users connect a web3 wallet like MetaMask to start trading. Each Set has its own value with a dedicated page describing which conditions the trading strategy favors. Every description also has a “learn more” page to provide more insight on what situations a given Set favors.

Why is this useful?

The analogy has long been made that blockchain technology is doing to finance what the internet did to the media by democratizing the creation of new financial instruments. By creating new use cases where backend operations are handled by protocols, and pairing that with an intuitive UI, TokenSets is attempting to set the stage for a massive influx of new users to decentralized finance.

As noted by Felix Feng, Co-Founder and CEO of Set Protocol in an interview with CoinList:

“In traditional markets, most people get exposure to investment products via packaged products such as ETFs, mutual funds, etc. In the same way, Set has the potential to be presented to the masses as the wrapper to get access to complicated products like money markets, margin trading, etc. Essentially, what we’re saying is that if we want to export DeFi to the masses, using an abstracting like Set seems to be the most natural way to do it.”

Predicting Bitcoin prices with a Token Set?

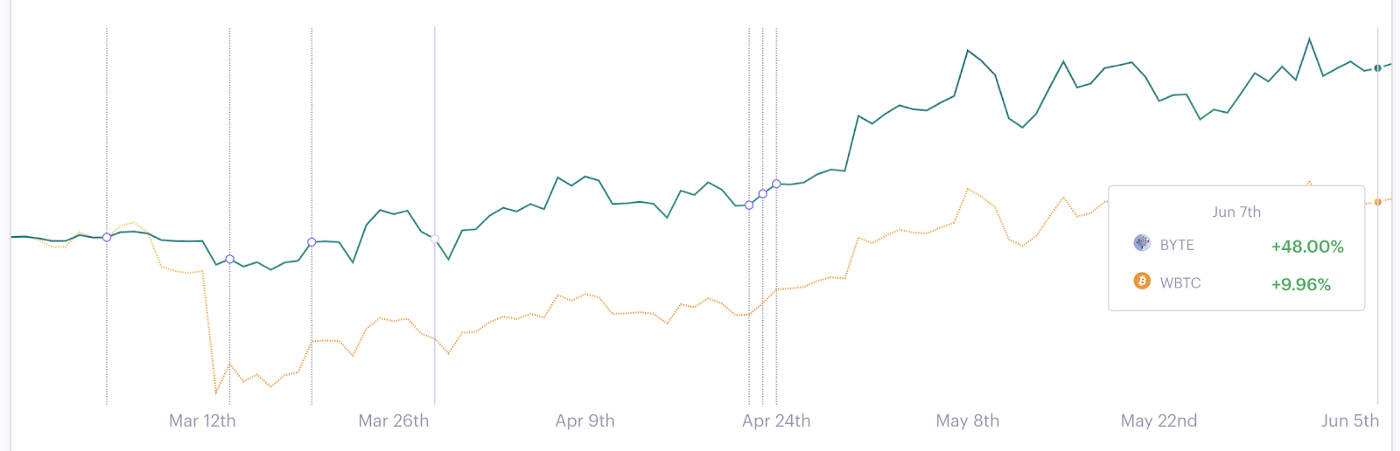

The biggest Set by market cap is BTC Network Demand Set II (ticker: BYTE). The Set looks basic: it is either long or flat WBTC depending on the perceived Bitcoin network demand, as measured by a host of parameters such as transaction count, volume, velocity, fees etc.

Since launch, BYTE has outperformed BTC by nearly 40%. A closer look at BYTE’s asset allocation explains the outperformance: the Set went 100% long USDC (= flat WBTC) on March 5th, one week before the bitcoin price collapse. Then, the Set slowly built back its 100% allocation to WBTC (= flat USDC), an allocation it had carried up until a few days ago.

In the last couple of days, BYTE has done something it had not done in a while: it moved all of its allocation from WBTC to USDC.

In other words, it’s internal signals are pointing towards a move lower in BTC/USD prices in the near future. BYTE has gone flat WBTC ahead of that move, selling close to $1M USD worth of BTC when it was trading $9,700. The last time BYTE did this was… on March 5th, one week before the crash.

Will the Set call the market as it did last March? Time will tell.

So where does WBTC come into play?

TokenSets exist exclusively on the Ethereum blockchain, so there are two things to keep in mind as you explore participating.:

- Token Sets are built upon Ethereum, and can only invest in ERC-20 tokens; and

- 1 BTC = 1 WBTC. On CoinList, there is no bid/offer to cross, just a straight 1:1 peg (plus conversion fees).

It may be obvious to many, but in order to participate in BYTE or any other Token Set, you need to hold ETH, USDC, or WBTC. You cannot participate with USD or BTC alone.

If you already have those assets, participating in TokenSets is easy. However, you may be building an unintended investment exposure e.g. if you buy the BYTE Token Set with ETH, you are implicitly running a short ETH/long WBTC position.

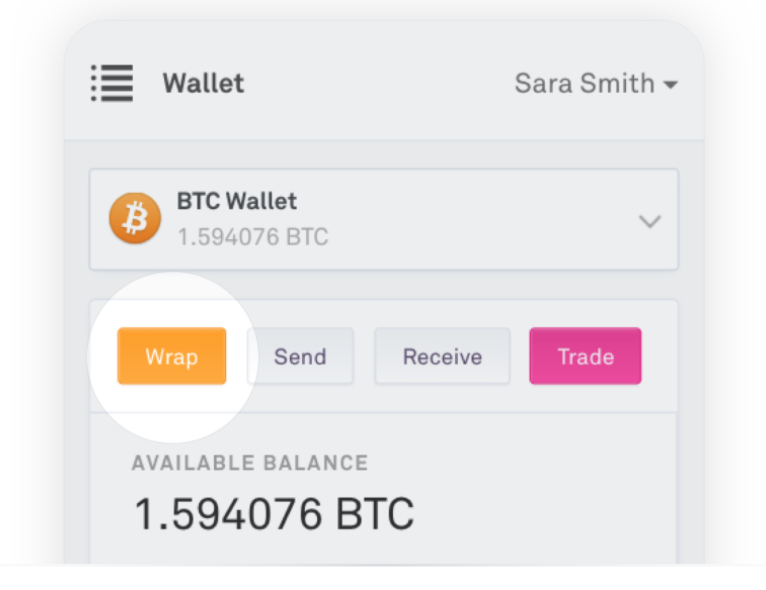

If, however, you are already holding BTC, you can easily wrap your BTC into WBTC to participate. Your overall exposure to Bitcoin would not increase and when you are ready to exit the Token Set, you could easily convert back into BTC through CoinList without the additional BTC/WBTC currency risk that may exist on an exchange.

Instantly wrap your Bitcoin and unlock decentralized finance from your CoinList wallet — https://coinlist.co/asset/wrapped-bitcoin

Legal Notice

This blog post is being distributed by Amalgamated Token Services Inc., dba “CoinList,” or one of its subsidiaries. This blog post and use of the CoinList website is subject to certain disclosures, restrictions and risks, available here.