How to use WBTC to earn interest on Compound

Welcome to the second installment of our series on what you can do with Wrapped Bitcoin (WBTC). By combining the ubiquity and maturity of BTC with the functionality of ETH, WBTC unlocks a world of possibilities that allow you to put your Bitcoin to work like never before.

In part one, we introduced TokenSets, a decentralized asset management platform that allows anyone to create their own crypto ETF or hedge fund. In this chapter, we explore how you can earn interest on your WBTC on Compound, a trending decentralized lending platform that has recently become one of the most valuable protocols in decentralized finance (DeFi). Let’s explore.

The Eighth Wonder of the World

“Compound interest is the eighth wonder of the world. He who understands it, earns it; he who doesn't, pays it.” -Albert Einstein

Before diving into Compound, let’s take a step back and note that for most people, the idea of earning interest when lending your money is a familiar concept. Most banks will pay you approximately 0.01% APR (annual percentage rate) on your savings deposits. If you shop around, you might be able to find high yield accounts that get you closer to 1%. These rates are determined by the interest rate borrowers are willing to pay for your money and typically follow the interest rates set by global central banks. In the current economic climate, central banks have set a policy of zero-interest rates (or in some cases even negative interest rates) in order to stimulate economic activity. If there is a near-infinite supply of money available from governments, interest rates in traditional markets will remain very low.

In crypto markets, however, there is no central bank authority that determines interest rates. The lending and borrow rates are simply determined by supply and demand (and risk), where crypto’s dramatic volatility can lead to outsized returns when compared with traditional markets.

What is Compound?

Compound is a protocol that allows people to lend and borrow crypto, and if you lend money to the protocol you can earn interest on your crypto holdings.

Like most DeFi protocols, Compound is a system of openly accessible smart contracts built on Ethereum. The platform allows borrowers to take out loans and lenders to provide loans by locking their crypto assets into the protocol. Unlike in traditional finance, the interest rates paid and received by borrowers and lenders on Compound are determined algorithmically by the supply and demand of each crypto asset. Interest rates are generated with every block mined. Loans can be paid back and locked assets can be withdrawn at any time. The protocol now supports BAT, DAI, SAI, ETH, REP, USDC, WBTC, and ZRX.

Borrowing crypto assets on Compound requires the value of your collateral to stay above a minimum amount relative to your loan. If the value of your collateral drops too far, you risk getting liquidated (having your collateral automatically sold to repay your loan).

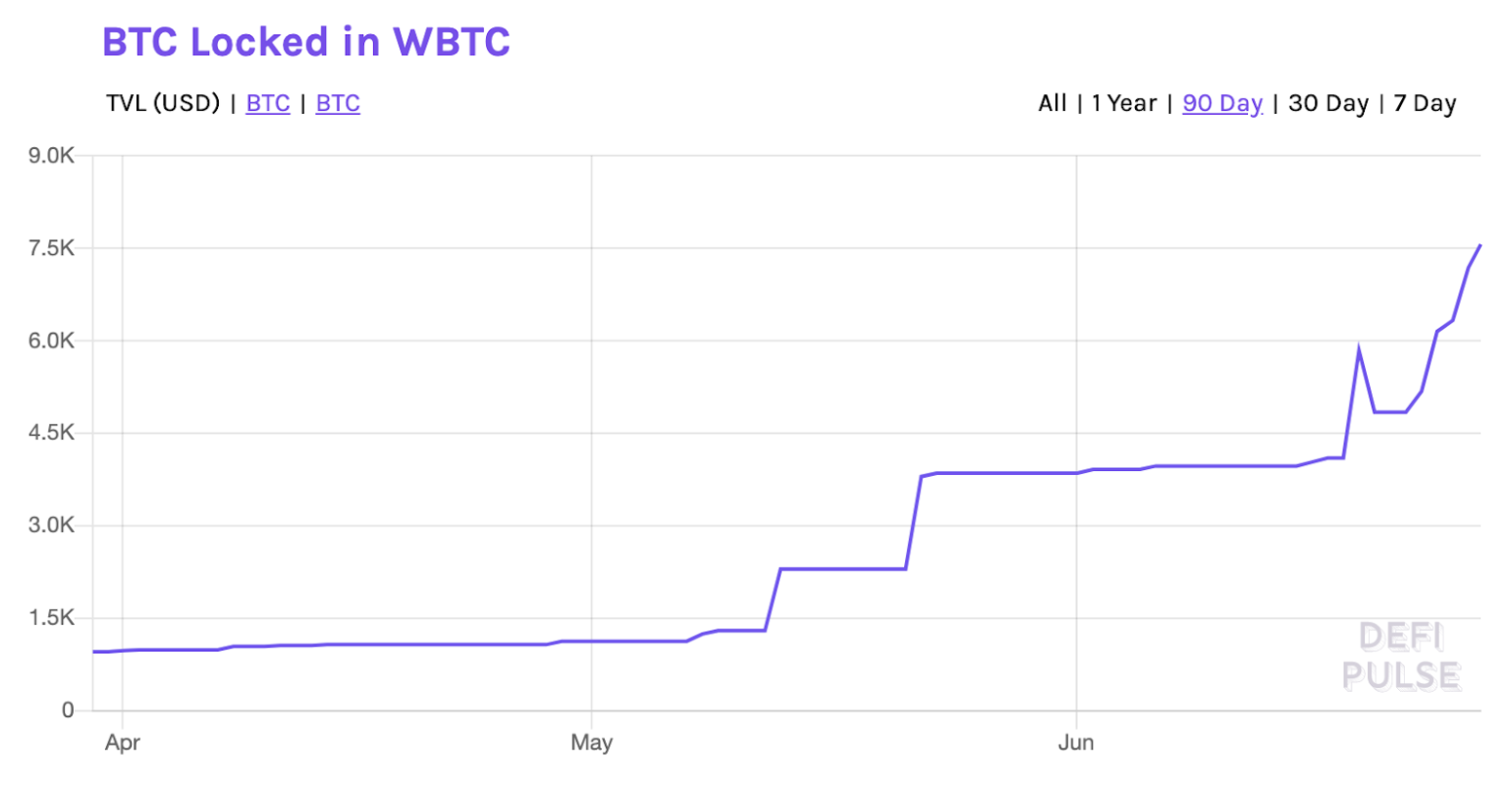

Currently, WBTC is not accepted as a collateral asset on Compound, which means you cannot borrow any crypto against your WBTC. Since WBTC growth has gone parabolic in the last few weeks, it may only be a matter of time before Compound accepts WBTC as collateral.

Getting paid to lend WBTC

WBTC is currently earning significant APR on Compound, a yield over one hundred times greater than the interest most banks pay on savings accounts. For example, those currently holding BTC can easily wrap their BTC into WBTC on CoinList, and could then deposit it into a Compound lending pool in order to earn yield.

What’s more, lending assets like WBTC on Compound lets users earn COMP tokens, the governance tokens that give holders a right to vote on decisions affecting the management of the protocol. Following its launch just last week, the COMP token surged in price and is currently trading at $218 on Coinbase.

The Comp token serves as an incentive to lend assets to the protocol because, the more you lend, the more COMP tokens you get. As COMP is the governance mechanism for users of the protocol, the resulting arrangement is akin to a cashback mechanism mixed with crowdfunding, as the rewards provide governance rights in the protocol, but are also fungible.

And here’s the most interesting part:

Those COMP tokens that lenders are getting? Borrowers get some too, every time they pay interest on a loan. And given market fluctuations, those COMP tokens are at times actually worth more than the cost of the fees to borrow. This has increased the demand and the interest that borrowers are willing to pay for WBTC loans on Compound, which in turn increased how much lenders can earn.

With roughly only 2,000 individual lenders currently available on Compound, there is potentially terra incognita for WBTC holders to earn yield through the protocol.

Instantly wrap your Bitcoin and unlock decentralized finance from your CoinList wallet — https://coinlist.co/asset/wrapped-bitcoin

Legal Notice

This blog post is being distributed by Amalgamated Token Services Inc., dba “CoinList,” or one of its subsidiaries. This blog post and use of the CoinList website is subject to certain disclosures, restrictions and risks, available here.