The race towards Central Bank Digital Currency and what that could mean for crypto

Around the world, central banks are flirting with digital currency. With plans for central bank digital currencies (CBDCs) underway in 46 countries including Sweden, France, Turkey, Uruguay, and China, the idea of “digital fiat currency” has rapidly escalated from a research project into something with very tangible implications.

CBDC is going to be a trending topic for years to come, and understanding what it is, how it compares with cryptocurrencies, how Covid-19 accelerated the debate, and what threats and opportunities it presents for Bitcoin is crucial for anyone in crypto to understand. In this post, we set the stage for this developing story and explore some of the key concepts and questions forming around this narrative.

What are central bank digital currencies?

Put simply, a central bank digital currency is fiat money — or money issued and controlled by a government through its central bank — in digital form. While no nation has formally launched a CBDC to date, a number of global jurisdictions are actively building and rolling out pilot projects.

In April, China’s central bank issued a notice stating they will “undoubtedly further research and development of the national digital currency with enhanced top-down design,” a strong signal of their commitment to creating a digital version of the yuan. China is already piloting a digital currency system in four large cities to replace some of its cash supply. Separately, central banks in Sweden, Switzerland, Japan, the U.K., the European Central Bank, and the Bank of International Settlements have joined forces this year to share knowledge and research on the potential adoption of CBDCs.

In theory, each CBDC unit will act like a secure digital equivalent of a paper bill, and can be used for payments, as a store of value and a unit of account. Much like a traditional currency bill that carries a unique serial number, each CBDC unit will be distinguishable to prevent imitation. As a part of the money supply controlled by the central bank, it will work alongside other forms of regulated money, like coins, bills, and bonds.

On opposite end of the spectrum

CBDCs might look and smell like crypto (both leverage a digital ledger that allows transactions to be recorded and viewed in real time by multiple parties), but they will be the furthest thing from decentralized currencies. Central banks will have fully transparent access to the ledger and will not be capping the supply of digital currency. The advantages and disadvantages are clear:

On one hand, CBDCs could help spread digital cash to the unbanked and help make traditional payment systems more efficient by reducing transfer and settlement time. In cases like China, a digital payment system coupled with identity tracking would also help in implementing monetary and fiscal policies more effectively.

On the flipside, CBDCs are highly centralized for maximum control by design and are in complete contrast to the permissionless and decentralized nature of cryptocurrencies like Bitcoin, thus raising privacy and surveillance concerns for its users. This invited significant criticism from organizations like the Human Rights Foundation, that see CBDC’s as potential economic tools for political oppression and social engineering.

How Covid-19 accelerated the debate

The CBDC discussion took center stage across the world this year as a potentially more effective way to deliver direct stimulus funds to people as a result of the coronavirus pandemic. Proponents believe that digital currency would solve the logistical question of how to quickly disperse large sums of money to many individuals and businesses with varying access to banking services.

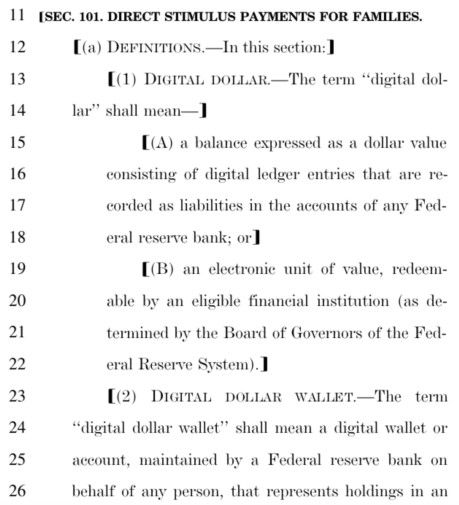

In the US, millions of Americans are still waiting for the promised stimulus checks to arrive as either direct deposits or physical checks from the U.S. Treasury Department. The proposals made before Congress this March would have charged the Fed with issuing both digital currency and digital wallets to give Americans direct access to funds. While these proposals did not quite make it to the final stimulus act, the conversation has indeed been started.

Are CBDCs good for Bitcoin?

While the jury is still out on this one, a case could be made that CBDCs may pave the way for continued retail and institutional interest in Bitcoin and other cryptocurrencies. If billions of people will have digital wallets and possess a new understanding and familiarity with digital money, the onramp from there to a non-sovereign, global currency like Bitcoin becomes much shorter and faster. If every financial institution has to build out the tools and infrastructure to safely store and transact CBDC, that same infrastructure could potentially be used for Bitcoin.

More importantly, however, is the fact that CBDC is still government-controlled fiat currency and fundamentally similar to the fiat currency we have today. As such, it is still prone to selective money printing and inflation. To hedge against monetary inflation and the decreasing purchasing power of fiat, you may consider doing what Paul Tudor Jones and David Swensen did: buy BTC.

Register to trade on CoinList and prepare for next market moves — https://coinlist.co/register

Legal Notice

This post is being distributed by Amalgamated Token Services Inc., dba “CoinList.” CoinList operates CoinList Markets LLC (“CLM”), a licensed money services business (NMLS #1785267), and CoinList Services LLC (“CLS”), a technology company that offers compliance and technology infrastructure solutions for token issuers. Neither CoinList, CLS nor CLM make investment recommendations, or provides legal, investment, banking, broker-dealer or tax advice or conducts investment diligence on token issuers or any tokens mentioned in this post, and no communication, through the CoinList website or in any other medium, should be construed as a recommendation to enter into any transaction or investment strategy in connection with any token or security offered on or off any Coinlist platform.

All information provided in this post is impersonal and not tailored to the needs of any person, entity, or group of persons and is not sufficient upon which to base a decision on whether or not to make a purchase. The services offered by CoinList Services LLC are provided for the benefit of token issuers, their supporters, developers, users and community, and the listing of tokens and token-based securities on the CoinList website does not suggest the future or expected value of any token or explicitly or implicitly recommend or suggest an investment strategy of any kind. These types of purchases involve a high degree of risk (including risk of total loss) and potential purchasers should consult with their own advisors. CoinList does not receive compensation for publishing, giving publicity to, or circulating notices or communications that describe securities. Potential purchasers must conduct their own due diligence of any issuer, cryptocurrency, token or token-based security. Use of the CoinList website is subject to certain risks, including but not limited to those listed here.

Certain services may be limited to residents of certain jurisdictions, and certain disclosures are required in certain jurisdictions, available here.

Virtual currency is not legal tender, is not backed by the government, and accounts and value balances are not subject to Federal Deposit Insurance Corporation or Securities Investor Protection Corporation protections.

This post contains external links to third-party content (content hosted on sites unaffiliated with CoinList). While CoinList uses reasonable efforts to obtain information from token issuers which it believes to be reliable, CoinList makes no representation that the information or opinions contained in this post, or any third-party content/sites that may be accessible directly or indirectly from this post, are accurate, reliable or complete. Linking to third-party sites in no way implies an endorsement or affiliation of any kind between CoinList and any third party. The information and opinions contained in this post are subject to change without notice, and this post is subject to the terms available here.