The Evolution of Token Distribution Models

Many have predicted the death of token issuance. They couldn’t be more wrong.

With bitcoin’s price going where it's going, more crypto capital will be looking for places to be put to work, and issuance is one of the primary places. It is one of the most dynamic corners of this industry, and we love being at the forefront of it. Smart investors know that being early is critical to success, and investing in cutting-edge cryptoassets before they list on major exchanges is about as early as you can get in venture financing.

With traditional equity markets being almost completely illiquid, slow, and restrictive to most individuals, investors worldwide are attracted to the liquidity, transparency, and powerful network effects of the crypto capital markets. In many ways, token issuance (in all its forms and glory) is revolutionizing the global capital markets and driving the democratization of high yield investment opportunities.

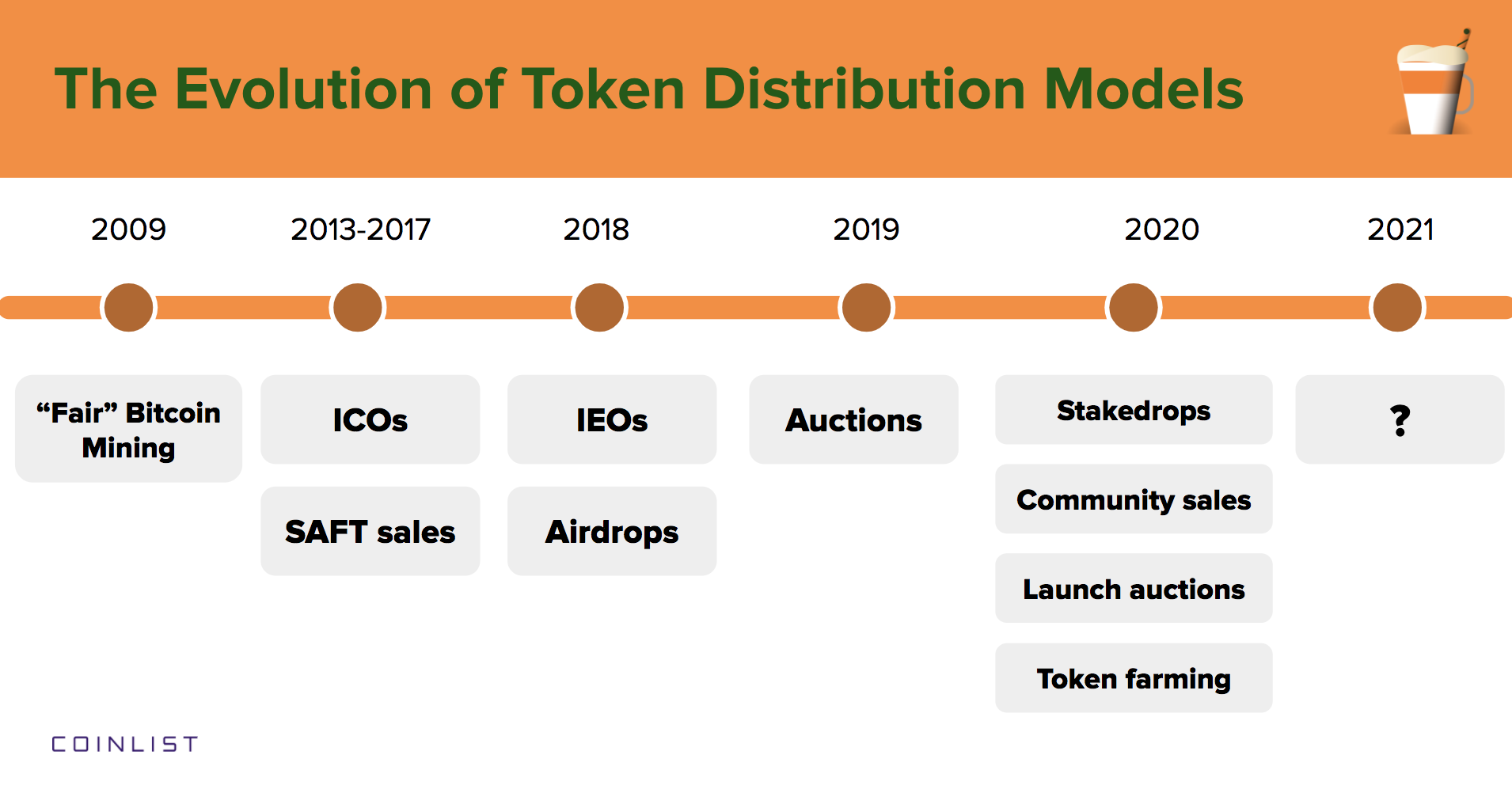

In just a few years of its young life, the crypto industry has spawned an ever-evolving array of exciting token distribution models that have captured investor attention. No sooner had the enthusiasm surrounding ICOs faded before the markets got caught up in the thrill of IEOs and token farming.

As we trace the evolution of token distribution models from Satoshi a decade ago to the present day, one can’t help but notice the staggering pace of innovation and experimentation. If 2020 is anything to go by, the next 12 months are bound to serve up some prime opportunities that excite both our community and make the broader crypto ecosystem thrive.

Let's dive in.

2009 — “Fair” Bitcoin Mining:

From the very beginning of Bitcoin, token distribution has formed a core component of any crypto network. In 2009, Satoshi Nakomoto engineered Bitcoin’s mining system to distribute new token supply to those supporting the network Nakamoto’s design ensured that most, if not all, network participants would be able to earn bitcoin for their work in supporting consensus. Although he could foresee the future of an ever-escalating hardware battle, his early goal was to bring as many people into the network as possible to ensure a sufficiently large distribution of stakeholders.

2013-2017 — Initial Coin Offerings & SAFT Sales:

As the industry started to mature, Initial Coin Offerings came on the scene as a novel way of launching a new blockchain project and distributing tokens. Interested investors were able to support the launch of a new protocol by contributing bitcoin to the early developers in exchange for pre-mined or already allocated tokens at network launch.

The first to take advantage of this new funding mechanism was Mastercoin in 2013. Although Mastercoin may no longer be a common household name, you will probably recognize it’s rebranded protocol, Omni, which was the foundation for USDT before expansion across other protocols. Ethereum quickly followed Mastercoin’s strategy in 2014 and raised more than 2700 BTC in the 12 hours of the pre-sale.

The promise of computational power on a blockchain unleashed by Ethereum opened the door to a whole new set of innovative opportunities. These opportunities combined with the relatively novel ERC-20 token standard made it extremely easy for innovators to launch a new token project on Ethereum. Billions of dollars poured into the ICO market through 2017 and 2018 (and continuing today) into both Ethereum based projects as well as novel blockchains designed to compete with Ethereum itself.

The quality of ICOs and the projects varied dramatically. Some of the 2017 era projects continue to develop and grow, while some are dead, and many were outright frauds. The sheer quantity and dollar amounts involved drove regulatory scrutiny across the globe and ultimately many teams shifted from the Ethereum-style ICO towards more regulated approaches including Simple Agreement for Future Tokens (“SAFTs”). CoinList and Protocol Labs developed the SAFT to allow accredited investors to participate in a compliant token sale, but many other projects eschewed public sales entirely by privately fundraising via equity or other instruments in private markets.

2018 — Initial Exchange Offerings & Airdrops:

After the dust settled on the epic crypto crash of 2018, new projects emerging on the scene began to disassociate with ICOs. The tokenization frenzy of the ICO days was seen by many as a catalyst both for its spectacular rise as well as the sharp fall that was to follow. In 2018 while ICOs continued, the growth and prominence of exchanges in the crypto ecosystem led to the development of IEOs, or Initial Exchange Offerings.

Unlike an ICO, which was originally conceptualized as a decentralized and populist fundraising mechanism, an IEO is administered by a crypto exchange on behalf of the project that seeks to raise funds alongside an exchange listing. Many token projects saw it as an opportunity to ensure liquidity for their token post-launch, while exchanges viewed it as an opportunity to reward their most loyal customers via allocations to selective pre-launch tokens.

Token issuers have to pay a listing fee along with a percentage of the tokens sold during the IEO. In return, the tokens of the project are sold on the exchange’s platforms, and their coins are listed after the IEO is over. IEOs tended to only exist on platforms outside of the United States and while IEOs have fallen out of favor to some degree they continue to persist on Binance and other Asian exchanges. Projects like Matic and Injective (first seen on CoinList Seed) leveraged the network effects of crypto exchanges to draw in massive audiences during their token distribution events.

2019 — Auctions:

Regardless of the abbreviation, most token sales were historically offered at a fixed price to prospective purchasers. There had been some experimentation with different pricing models including Gnosis’s auction or Ethereum’s own increasing price ICO. CoinList introduced a Dutch auction mechanism to facilitate a more fair and accurate price discovery.

In a Dutch auction, the seller sets an initial price per token and then units are sold beginning from the highest bidder downward until the auction “clears.” Participants place bids for the number of tokens they would like to purchase and provide the maximum price per token that they are willing to pay. Every participant is guaranteed an allocation, as long as their price is above the clearing price, regardless of their purchase amount and each successful participant buys tokens at the same price; and all participants collectively determine that price.

Two standout examples were the Celo and Solana auctions on CoinList that exposed the projects to thousands of bidders across 130+ countries.

2020 — Liquidity Farming, Stakedrops, and Community Sales:

The last twelve months have seen innovation in the token model space accelerate tremendously. From stakedrop distributions such as NuCypher and Oasis, to community sales from Near and Flow, it was exciting to be in the trenches of token issuance in 2020.

Many projects, however, particularly in the red-hot DeFi sector, chose to bypass token sales entirely and instead experiment with a novel class of distribution models. Led by Compound, several DeFi projects launched and distributed their tokens directly into the hands (wallets) of their protocols’ users. Uniswap, 1inch, Compound together airdropped more than $1B in tokens to their users in 2020, simultaneously incentivizing usage and giving users a say in governance.

It is worth noting that many token distribution mechanisms in DeFi do not include a fundraising component, instead focused on distributing tokens to users that are providing value to the network (ie providing liquidity), much like Satoshi did with Bitcoin mining. This process is not without its problems, however, as Andre Cronje of Yearn Finance pointed out in his self-proclaimed rant that went viral last week:

“Your value is only as good as your token. Token go up? You built an amazing protocol, it’s the future of finance, blah blah. Token goes down? You are a scammer, fake project, bad coder, etc.”

Token issuance in DeFi is going through what any new technology or disruption in the capital markets goes through — a period of chaotic activity and growing pains, followed by realignment and efficiency.

2021 — A Cornucopia of Issuance & Fundraising Strategies:

With growing acceptance of stakedrops, community sales, launch auctions, DeFi token distribution, and huge momentum around Polkadot and its Parachain Crowdloans (PCLs), token issuance in 2021 promises to serve up prime opportunities for investors.

It is likely that token distribution in 2021 will start to blend key elements from traditional token sales (engaging the crowd) and DeFi token issuance (empowering users to provide value to the project). We see increased alignment of incentives between projects and token holders in 2021, making this one of the dynamic corners of the crypto industry.

Tune in to CoinList next week for an in-depth look at what we believe will be one of the hottest token issuance trends in 2021.

Legal Notice

This blog post is being distributed by Amalgamated Token Services Inc., dba “CoinList,” or one of its subsidiaries. This blog post and use of the CoinList website is subject to certain disclosures, restrictions and risks, available here.