Building Community in Crypto: The Evolution of Token Distribution Models

Building crypto networks is hard. For a protocol to be successful, it needs validators who run nodes that secure the network; token holders need to feel empowered to participate in governance; DAO members need to be motivated to contribute to the protocol’s development; developers need tools to build on top of the protocol; the list goes on. Bootstrapping all those processes boils down to one thing: quality communities.

Engaged communities actively use the network’s token and contribute to the protocol’s growth initiatives. This increases the project’s value and token demand, which create economic incentives for existing users. The users then become more motivated to grow the protocol and more engaged. Once established, this positive feedback loop can be unstoppable, which is why thoughtful, well-designed initial token distributions are key to protocols’ long term success. Quality token distributions attract good users and help projects launch with an active and aligned group from day one. It’s the most effective mechanism for bootstrapping engaged communities.

So how should projects design their initial token distribution to maximize quality?

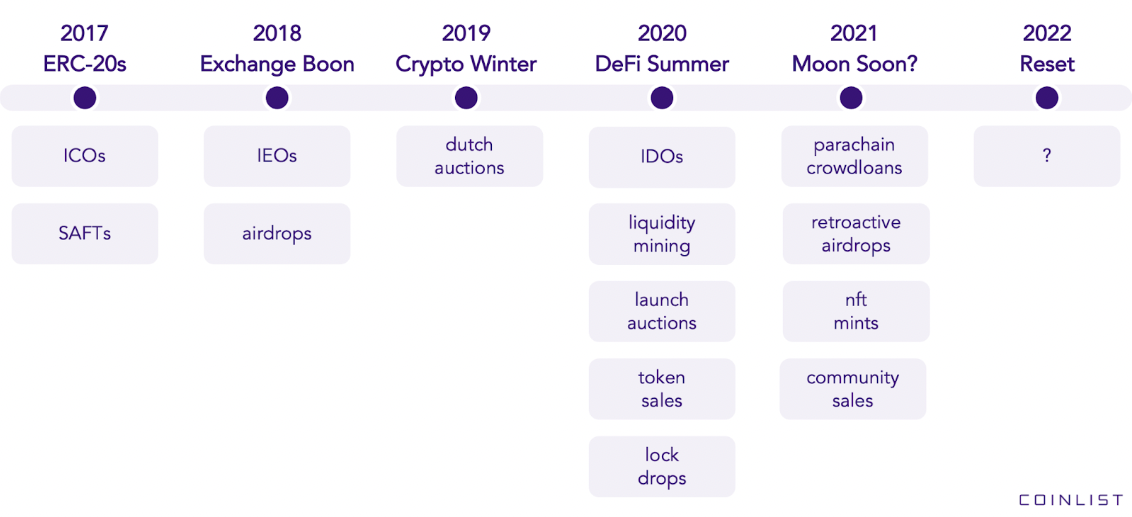

The Evolution of Token Distribution Models

Before diving into what the optimal distribution model is, one must understand the evolution of token distribution models. In just a few years of its young life, the crypto industry has spawned an ever-evolving array of exciting token distribution models that have captured widespread attention.

2017 - Initial Coin Offerings (ICO) and SAFT Sales

Ethereum’s ERC20 standard took off in 2017, which allowed developers to easily launch tokens. Simultaneously, SAFTs were invented which made constructing public token sales’ legal structures easier. These unlocks led to the ICO boom – crypto’s version of IPOs, where projects sell a percentage of supply to the public to fundraise and distribute tokens to potential users. The industry saw an explosion in experimentation and thousands of projects emerged. Although many projects never gained sustainable traction, projects like Filecoin were born.

2018 - Initial Exchange Offerings (IEOs)

Projects that ICO’d quickly learned that distribution was not enough. The tokens need exchange listings for reach and liquidity. Coincidentally, centralized exchanges like Binance took off, which unlocked a new model: IEOs. Projects signed agreements with exchanges to conduct ICOs on their platforms in exchange for a guaranteed listing. This solution ameliorated the liquidity problems projects experienced. Alongside the IEO model, teams like DFINITY started experimenting with airdrops where users who fulfill certain requirements receive free tokens.

2019 - Dutch Auctions

Though IEOs addressed the liquidity problem, they still succumbed to the cruel crypto winter. Investor activity grinded to a halt and teams ran out of cash one after another in 2019. Projects started to obsess about how to price their tokens accurately upon launch. This led to the new unlock: dutch auctions – a price discovery mechanism where the price of tokens could be determined after taking in all bids to arrive at the highest price at which all the tokens could be sold. An example was the Algorand auction on CoinList that exposed the project to thousands of bidders across 130+ countries.

2020 - DeFi Summer

The market turned in 2020 and saw a Cambrian explosion of DeFi protocols. Teams learned about the importance of ease of launch, token liquidity, and initial price discovery from the last few years. This, combined with the adoption of automated money markets (AMMs) and other DeFi primitives, unlocked new models like Initial Decentralized Exchange Offerings (IDOs), Liquidity Mining programs, and Launch Auctions. Thousands of new protocols launched on decentralized exchanges (DEXs) via liquidity pools and competed for users with liquidity mining programs that offered high yields. During this period, traditional ICO-like token sales saw a comeback, and teams also started experimenting with other distribution formats like the NuCypher WorkLock and the Oasis Lock Drop.

2021 - Moon Soon?

The bull market accelerated in 2021. New blockchains gained steam, taking the learnings from Ethereum and applying them to their ecosystems. Polkadot introduced their Parachain Crowdloan Auctions that were inspired by Lock Drops. Cosmos projects improved upon the airdrop model and used it as the de facto distribution method for new launches. NFTs gained mainstream adoption and introduced whitelist sales. Projects like Mina launched community sales that offered preferred terms to existing users.

2022 - Reset

Parties don’t last forever. Russia invaded Ukraine, Luna and UST collapsed, the global economy experienced record inflation, and the crypto market tanked.

This brings us to a timely reset for the industry. So what have we learned and unlocked? And what will the distribution models of tomorrow be?

Learnings From The Last Cycle

1. Airdrops are increasingly exploited by bad actors

Airdrops are currently one of the most popular token distribution models, as shown by the Optimism airdrop. However, because they happen on-chain, there’s no reliable way to identify the recipient. This creates two problems: airdrop farmers who game the system to receive outsized airdrop allocations, and unengaged users who dump the token immediately.

To many, airdrops are nothing but free money, most recently illustrated by the botched Optimism airdrop that saw the OP token down over 70% after many airdrop recipients immediately sold the freshly claimed tokens. Airdrops need a better way to identify recipients and incentivize them to use the tokens.

2. Communities are more sensitive to VCs’ large allocations

VCs have become increasingly influential and projects have been allocating more tokens to them. There’s often less than 5% of supply left for the community by token launch. Jack Dorsey summed this up in a Tweet, “You don’t own ‘web3.’ The VCs and their LPs do.” The public has become increasingly allergic to this and has reacted poorly to projects with outsized VC allocations. To build a strong community, projects need to reserve more tokens for the public and offer them better terms (ie. lockups, price, etc).

3. Regulators are scrutinizing the crypto industry more closely

With crypto’s global market cap increasing and unsophisticated investors losing money to scams, regulators are paying more attention to the industry and drafting new regulations. Regulatory clarity is good for the industry as it helps good actors know what rules to abide by. But it also means projects need to have more robust regulatory and legal strategies.

4. Cross-chain bridges and on-chain analytics broaden on-chain identity applications

As more ecosystems like Cosmos and Solana gain traction, bridging technology has matured. Cross chain bridges like Axelar allow users to hop between Ethereum, Cosmos, Solana, and other blockchains easily. Simultaneously, on-chain analytics projects have gained traction and significantly reduce the difficulty of understanding users’ on-chain activity.

Dune Analytics, for instance, allows anyone to create blockchain queries using SQL and look into wallets’ on-chain behavior. With the combination of interconnected ecosystems and better on-chain data analytics, on-chain identity has flourished. Projects can now quickly find out what people are doing on-chain, across multiple chains, and construct user identities based on this information. These profiles are critical for projects to more accurately decide who would be a high quality user to distribute tokens to.

The Future Of Token Distribution

As we look to the future, we believe that token distribution will remain one of the most dynamic corners of the crypto industry, and that the distribution models of tomorrow will be all about curated distributions.

Projects launching tokens will confirm users’ real identities and focus on users with proven track records of contributing to protocols, rather than airdrops to misaligned, malicious actors. Curated distribution based on value-add activities and on-chain behavior will lead to more engaged communities. So how exactly do curated distributions work, and what products will CoinList offer to make them possible?

Stay tuned for part 2 of this series coming soon!

Legal Notice

This blog post is being distributed by Amalgamated Token Services Inc., dba “CoinList,” or one of its subsidiaries. This blog post and use of the CoinList website is subject to certain disclosures, restrictions and risks, available here.